Recognizing that the recent climate change issues should be regarded as a climate crisis on a global scale and thus one of our significant management challenges, the Maruichi Group would like to contribute to the achievement of a “world where the average temperature rise should be limited to 1.5°C above pre-industrial levels,” as adopted in the Paris Agreement, by performing our business activities in prudent consideration of all stakeholders on earth.

To this end, the Group agrees to the recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD), based on which we will disclose our information concerning our "Governance," "Strategy," "Risk Management," and "Metrics and Targets."

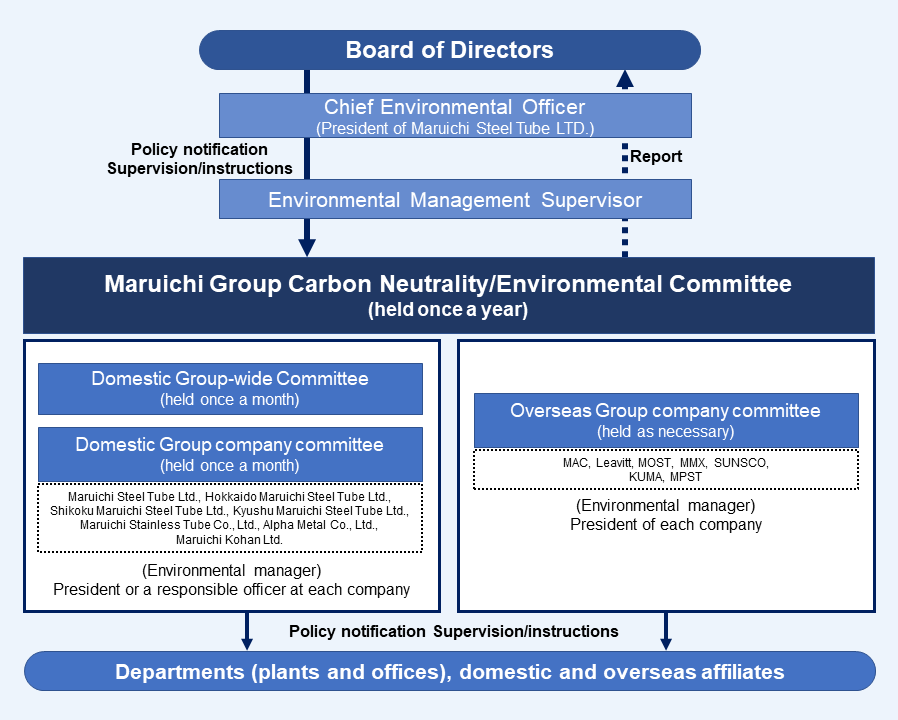

In order to respond to our various environmental challenges, including compliance with environmental laws and regulations relating to climate change issues, we have appointed environmental managers at both domestic and overseas Group companies, and established the “Maruichi Group Carbon Neutrality/Environmental Committee” headed by the Chief Environmental Officer (President) at the top (hereinafter referred to as “Committee”).

The Committee holds a plenary session, “as a general rule, once a year,” to discuss matters related to global warming prevention measures, water security actions, preservation of biological diversity, actions against environmental pollution, chemical substance management, waste disposal reduction, and other environment-related issues.

Each Group company shall establish a “Group Company Carbon Neutrality/Environment Committee” under the president or a responsible officer (hereinafter referred to as “Company Committee”) to run the PDCA cycle properly, based on the analyses and planned countermeasures reflecting each company’s situations. Domestic Group companies composing the Committee hold a Domestic Group-wide Committee meeting “as a general rule, once a month,” to share common goals and strengthen inter-company coordination.

The Chief Environmental Officer (President) decides Group-wide policies and measures on carbon neutrality/environmental preservation challenges, and reports the progress and environmental preservation status to the Board of Directors biannually. Important matters concerning climate change issues are decided, supervised, and instructed by the Board of Directors.

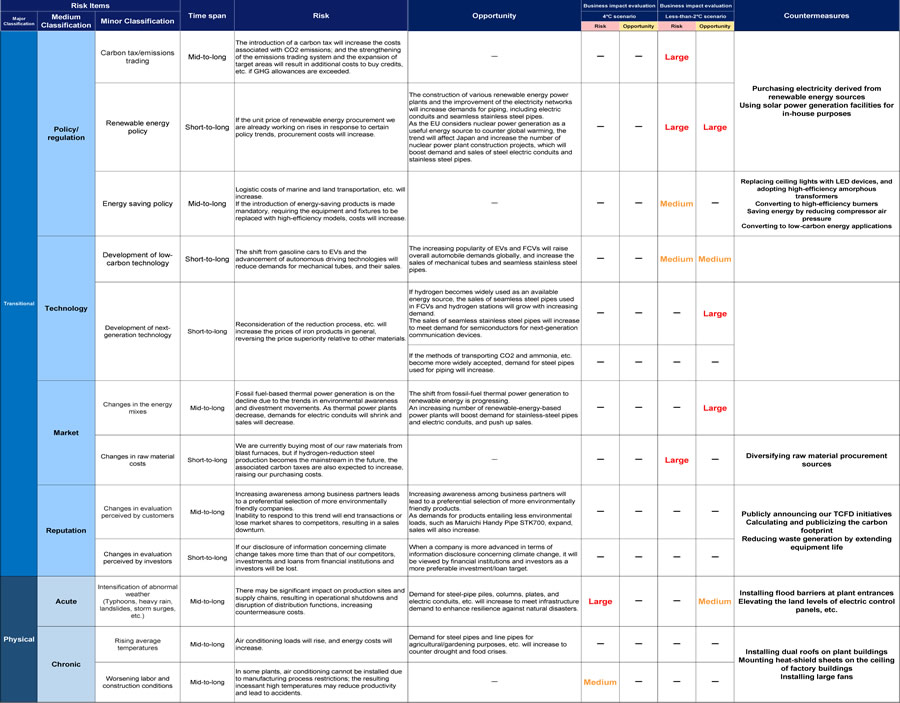

We summarize risks and opportunities related to climate change throughout our entire supply chain to review business impact and proper countermeasures. For scenario analyses, we adopt the “4°C” and “2°C or less” scenarios, announced by the IPCC and IEA. In the “4°C” scenario, we assume the global temperature rising by 4°C on average by around 2100 over the pre-industrial levels, and recognize the possibility of worsening abnormal weather conditions, including typhoons and heavy rainfalls. The “2°C or less” scenario anticipates a world where the average temperature rise will be limited to around 1.5°C to 2°C above the pre-industrial levels due to carbon-neutral initiatives, including the introduction of carbon taxes and renewable energy policies. We have conducted analyses on the impact of these world-views on us as of 2030.

We have identified various risks and opportunities anticipated in each scenario, and conducted provisional calculations on the financial impact in 2030 concerning the items that can be quantitatively analyzed.

In the “4°C” scenario, we recognize the possibility of considerable financial impact of worsening abnormal weather conditions, which will increase risks on our domestic facilities and cause significant financial impact. On the other hand, in the “2°C or less” scenario, we anticipate our Group-wide risks associated with the introduction of carbon taxes in developed countries that have issued carbon neutrality declarations, and our increasing operational costs due to soaring domestic power prices, triggered by changing electric power supply structures due to decarbonization. Furthermore, we also recognize that global steel prices will be raised due to the changes in steel manufacturing methods in conjunction with the decarbonation trend, and that the subsequent procurement cost increases will have a significant financial impact. In order to act on the risks identified in our recent scenario analyses, we are determined to continue our studies on countermeasures and respond to anticipated future changes.

On the other hand, we recognize opportunities, among other things, in increasing demands, rising out of various innovation opportunities, including (i) mechanical tubes that can respond to increasing semiconductor demand due to broadening uses/expansion of carbon-free/renewal energy systems and widespread acceptance of EVs/FCVs and automated cruising systems, (ii) structural tubes and steel plates for facilities to counter disasters caused by climate changes and for maintenance and improvement of living environments, and (iii) steel pipes for agricultural/gardening purposes to counter food shortages caused by global population growths. They can be properly responded by our wide range of tubing/piping product lines and our production/sales networks primarily located in Japan, North America, and Asia.

As for countermeasures to risks, particularly associated with rising average temperatures and extremely abnormal weather conditions, we install, for example, dual roofs on plant buildings and large fans, and flood barriers at plant entrances to block storm surges. In addition to plans to elevate the land levels of electric rooms, we ensure that proper insurance is procured for properties against wind/flood-caused disasters. We also have solar power facilities generating a total of 12 megawatts on the premises and rooftops of our domestic plants, currently selling the electricity to electric power companies. In the future, we, including overseas Group companies, will also use solar power for our in-house operations and replace the existing facilities with more efficient ones. Against the risk of increasing procurement costs, we can diversify our raw material supply sources, etc.

* This table is created by excerpting items identified as necessary in the respective TCFD Guides compiled by the Ministry of the Environment.

* The periods indicated in the above Table are as follows: “short term,” from 0 to 3 years; “medium term,” from 4 to 10 years; and “long term,” 11 years or longer.

* The business impact evaluations are based on currently available parameters (as of June 2022).

* The indications in the business impact evaluation columns represent our recognition of relative materiality in estimating our future strategies, etc., and do not necessarily indicate impact levels on our overall corporate financial positions.

* The indication of "-" in the business impact evaluation columns means that the evaluation is difficult or relatively insignificant at present.

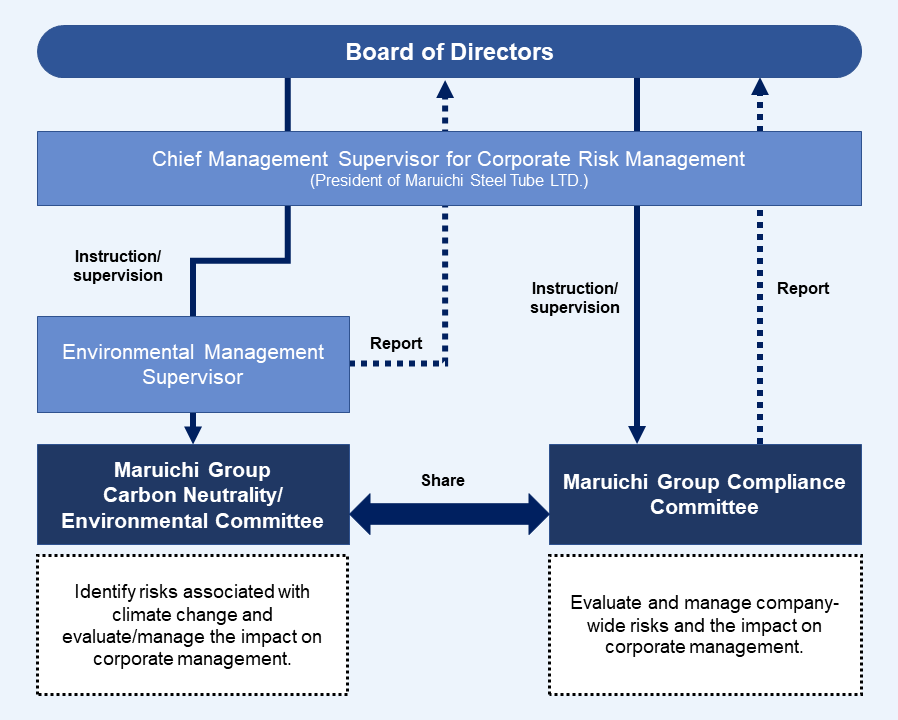

Given the increasing uncertainties surrounding corporate environments, we believe that it is essential to appropriately address risks that have significant impact on corporate activities in order to carry out our management strategies and pursue our business objectives.

The Maruichi Group has the “Compliance Committee” to manage risks. The "Maruichi Group Carbon Neutrality/Environmental Committee" mentioned above identifies "transitional risks" and "physical risks" associated with climate change, evaluates and manages the levels of financial impact, and shares the information about the risks with the "Compliance Committee," which then assesses them in relation to company-wide risks and compares/reviews priorities, based on the frequency of occurrence and financial impact, etc. In addition, we have established a system for proper management of company-wide risks by periodically monitoring risks assessed as significant. The contents of these discussions are reported to the Board of Directors; and action policies and countermeasures are reflected systematically in management strategies and medium-term management plans.

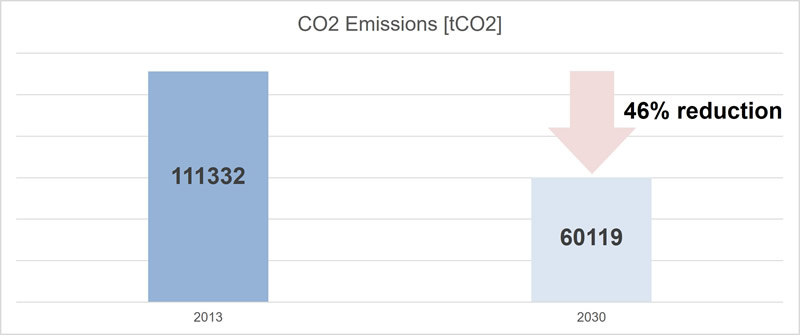

We use the total amount of emitted carbon dioxide (CO2: a greenhouse gas) as an indicator to assess and manage the impact of climate change challenges on corporate management.

With the fiscal 2013 CO2 emissions within the entire domestic Group companies as a benchmark, we aim to reduce CO2 emissions by 46% by fiscal 2030; and our CO2 emissions have been on a downward trend for the past five years. Measures we have taken so far include:

The adoption of high-efficiency equipment, including such energy-saving devices as LED ceiling lights, promotion of energy-saving activities, and purchase of electricity derived from renewable energy sources. While continuing these conventional efforts, we will also work on internal uses of solar power generation and the purchase of electricity derived from renewable energy.

As for overseas Maruichi Group companies, CO2 emissions are also monitored individually, and efforts are made to promote the use of LED ceiling lights, etc., as in Japan. In line with CO2 emission reduction targets specified in each country, we will promote reduction activities.

Considering the introduction of renewable energy as an important challenge to be tackled, we started the installation of solar power generation facilities in 2013, and have been contributing to the reduction of CO2 emissions by selling the generated electricity to electric power companies.

In addition, we have made a plan to increase the use of renewable energy to approximately 40% of our domestic electricity consumption by fiscal 2030, including internal use of the electricity generated by our solar power generation facilities.

We started calculation of Scope 3 emissions in fiscal 2020, to identify GHG emissions in 10 categories.

Unit: t-CO2

| 2013 | 2020 | 2021 | |

| Scope1 | 111,332 | 23,994 | 24,496 |

| Scope2 | 65,930 | 60,018 | |

| Scope3 | ― | (1,744,543) | 1,665,046 |

Notes

・Scope 2 for fiscal 2021 is the amount of emissions after reduction due to purchased electricity derived from renewable energy.

・Scope 3 calculations include categories 1 to 7, 9, 10, and 13.

・Scope 3 for fiscal 2020 is being recalculated due to changes in part of the calculation methods.